section 4d rental income tax computation

Income Tax Return for Cooperative Associations Schedule J line 5c. Exempt under section 501c15 should file Form 990 Return of Organization Exempt From Income Tax.

Special Tax Deduction On Rental Reduction

If the line 12 amount exceeds the domestic corporations US.

. You are either self-employed or employed by an organization that isnt exempt from tax under section 501c3 of the Internal Revenue. Other conditions required to be fulfilled by a specified fund referred to in clause 4D of section 10 of the Act. Subject to taxation under section 831 and disposes of its insurance business and reserves or otherwise ceases to be taxed under section 831 but continues its corporate existence while winding up and liquidating its affairs should file Form.

Tax-exempt interest on certain private activity bonds issued in 2009 and 2010. Return under section 1394D is required to be filed by every university college or other institution which is not required to furnish return of income or loss under any other provision of this section. Part I Tax Computation.

Rental income other than house properties Gifts received. Any person making a false. The taxpayer is a cooperative and the source credit can or must be allocated to patrons.

ASCII characters only characters found on a standard US keyboard. Enter one-half of the Additional Medicare Tax if any on self-employment income one-half of Form 8959 line 13 7. Attach a statement to your federal income tax return to show your computation of both the tax and interest for a nonqualified withdrawal.

NIIT is a 38 tax on the lesser of net investment income or the excess of modified adjusted gross income MAGI over the threshold amount. Special rules apply to refunding bonds. 6 to 30 characters long.

As per Section 192 of the Income Tax Act the employer will withhold taxes if the employees do not come within the taxable bracket. For the year Jan. You may be subject to the NIIT.

Net investment income may include rental income and other income from passive activities. Income loss reported in box 9 Code C1 is a passive activity amount for all general partners. Any rental real estate loss allowed under section 469c7 to real estate professionals defined earlier.

Include the tax and interest on Schedule 2 Form 1040 line 21. Line 12Adjustment for Tax-Exempt Income. For more details see the instructions for Form 1041 US.

What is the ITR-5 Form. If this is the initial Form 990-PF return of a former public charity under section 170b1Avi or 509a2 or 509a3 then the organization is treated as a private foundation for the tax year being reported only for purposes of section 6033 filing Form 990-PF section 4940 paying excise tax on investment income and section 507. For more details see the instructions for Form 1120-C US.

I NDIVIDUAL I NCOME T AX R ETURN. General partners taxable income or loss from other rental activities. _____ Tier 1 RRTA taxes as an employee of a railroad enter amounts on lines 8 9 10 and 11 or employee representative enter amounts on lines 12 13 14 and 15.

Boxes 6 through 8Ordinary Business Income Rental Real Estate and Other Rental Income. Manner of computation of income under tonnage tax scheme. Department of the TreasuryInternal Revenue Service 99 2011 US.

Section 12 of that act sets forth the labor standards which must be contained in any contract for loans annual contributions sale or leases pursuant to the act and provides that 1 all laborers and mechanics employed in the development of a CIAP-funded lower income housing project be paid DBRA wages and 2 all maintenance laborers and. The transaction appears in detailed mode in table 4D1 of GSTR-3B as shown below. Health insurance policies generally provide coverage to the insured person spouse and dependent children.

Tax-exempt interest on certain housing bonds issued after July 30 2008 excluded under section 57a5Ciii. 1545-0074 IRS Use OnlyDo not write or staple in this space. In section 245B of the Income-tax Act in sub-section 1 the following proviso shall be inserted and shall be deemed to have been inserted with effect from the 1st day of February 2021 namely Provided that the Income-tax Settlement Commission so constituted shall cease to operate on or after the 1st day of February 2021.

Use Form 8960 to figure this tax. Click here to view the latest ITR-5 form from the Income Tax Department. Schedule GTax Computation and Payments.

The premiums paid on the health insurance comes under this section of income tax deduction. 31 2011 or other tax year beginning 2011 ending. This income tax return is meant for firms LLPs AOPs Association of persons and BOIs Body of Individuals Artificial Juridical Person AJP Estate of deceased Estate of insolvent Business trust and investment fund.

Report income on Schedule E. 300001 but less than Rs5 lakh. Net investment income tax.

Net Investment Income Tax NIIT. Part-B Outline of the total income and tax computation with respect to income chargeable to tax. Eligibility of tax credit during purchases but reversed later due to ineligibility Record a purchase invoice for stock item on which tax credit can be claimed as shown below.

From AY 2013-14 onwards. Form 1041-N is the trusts income tax return and satisfies the section 6039H information reporting requirement for the trust. Additional Medicare Tax on Self-Employment Income.

Report a loss following the Instructions for Form 8582. Boxes 6 through 8Ordinary Business Income Net Rental Real Estate Income and Other Rental. If you pay your health insurance premiums you can save your taxes up to Rs.

Line 10 Estate Tax Deduction - If any Income in Respect of a Decedent IRD was included in the Income Distribution Deduction taken by the entity that issued the K-1 Form 1041 on that entitys Form 1041 and that estate or trust was also allowed a deduction under section 691c for any estate tax paid that is attributable to such income. Gross total income Tax Computation. Income Tax Return for Estates and Trusts Schedule K-1 box 13.

Line 4d see TIP earlier. Any qualified shipping income excluded under section 1357. Additional Director means a person appointed to be an Additional Director of Income-tax under sub-section 1 of section 117.

A tax credit allowed pursuant to this section shall be in the amount provided in subsections d. Ordained commissioned or licensed ministers of the gospel may be able to exclude from income tax the rental allowance or fair rental value of a parsonage that is provided to them as pay for their services. For more information see the Instructions for Form 8995 Qualified Business Income Deduction Simplified Computation or Form 8995-A.

Should be attached to your Schedule K-1. Income tax liability the excess is deemed an overpayment and can be claimed on the domestic corporations income tax return as a refundable credit Form 1120 Schedule J Part III line 20d or the corresponding line of other corporate income tax returns. Of this section against the corporation business tax imposed pursuant to section 5 of PL1945 c162 C5410A-5 or the gross income tax imposed pursuant to the New Jersey Gross Income Tax Act NJS54A1-1 et seq whichever of the two.

Must contain at least 4 different symbols.

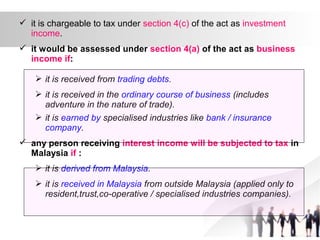

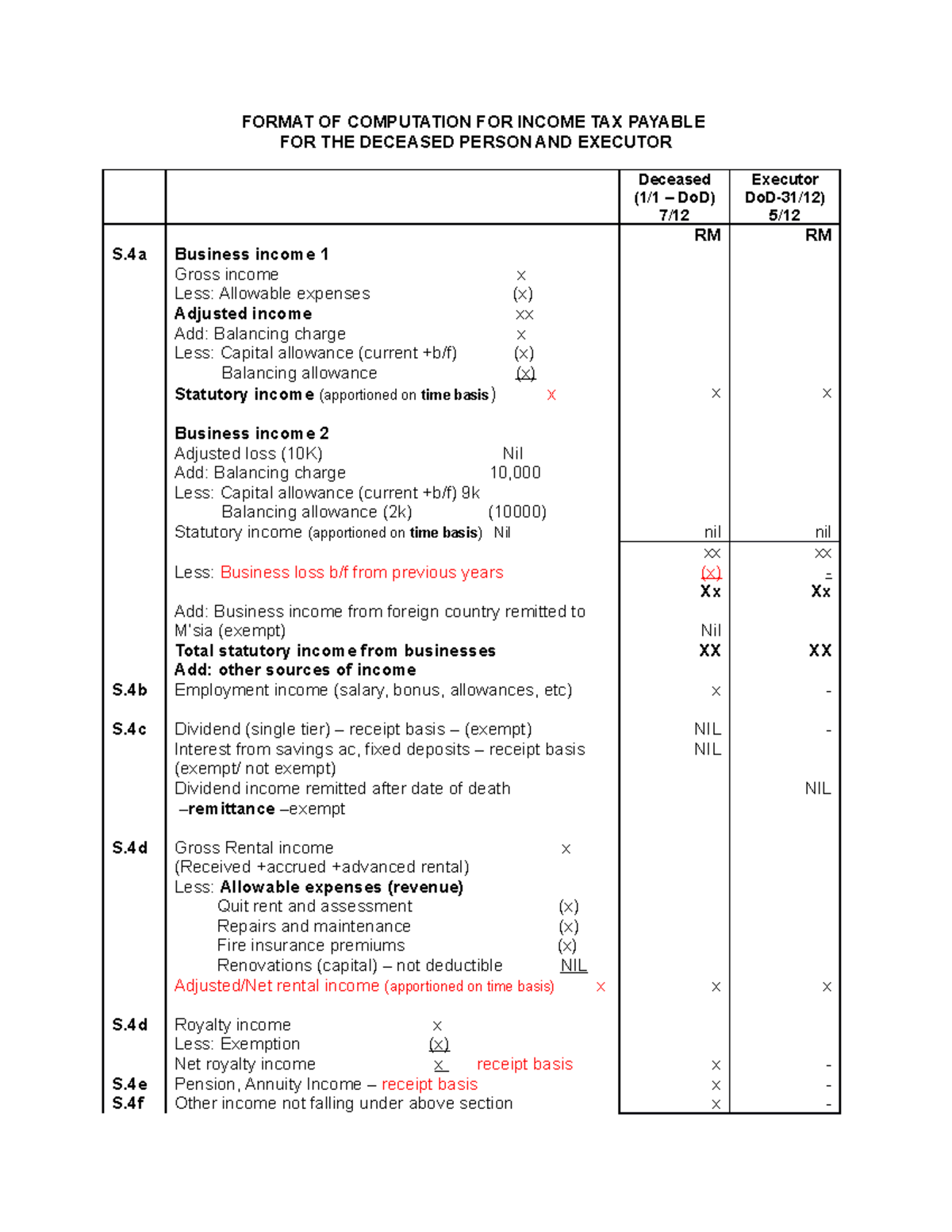

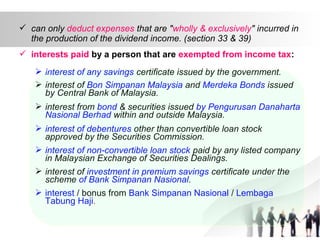

Taxation Principles Dividend Interest Rental Royalty And Other So

Itr 7 Indian Income Tax Return Taxguru

3 11 16 Corporate Income Tax Returns Internal Revenue Service

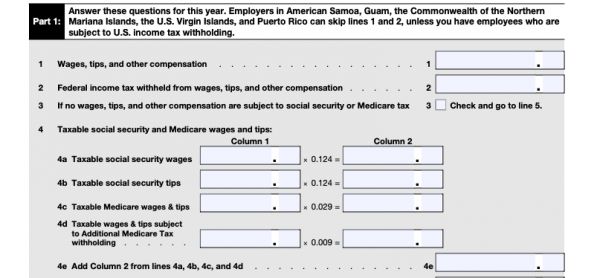

Irs Form 944 Instructions And Who Needs To File It Nerdwallet

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Sec Filing 4d Molecular Therapeutics

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Sec 199a And The Aggregation Of Trades Or Businesses

Special Tax Deduction On Rental Reduction

How To Calculate Taxable Income On Rental Properties 10 Steps

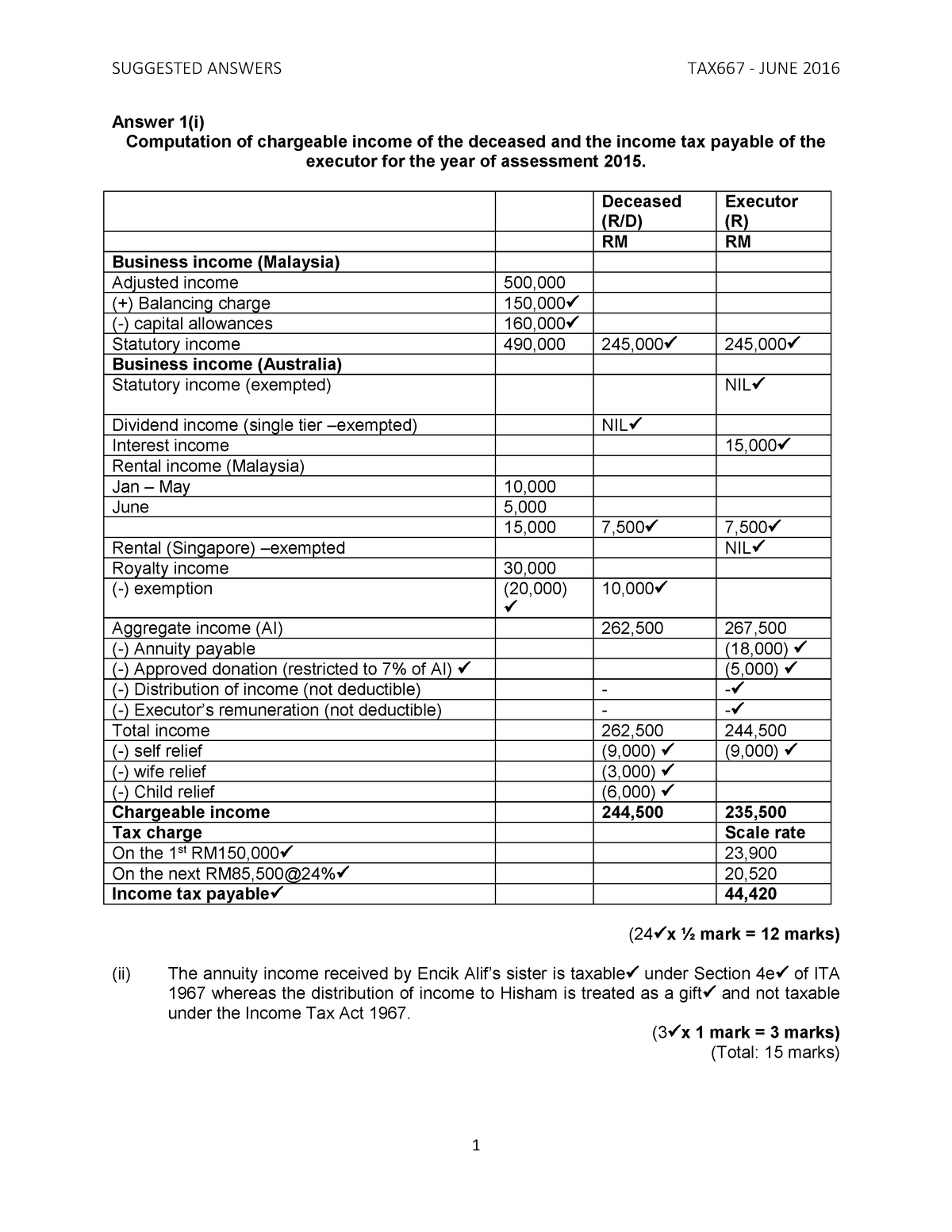

Solution Tax667 Jun 2016 Answer 1 I Computation Of Chargeable Income Of The Deceased And The Studocu

Income Tax Computation Savings Income Acca Taxation Tx Uk Fa2018 Youtube

Computation For Individual Tax Liability For The Year Of Assessment 2019 Format Of Computation For Studocu

Malaysia Taxation Junior Diary April 2011

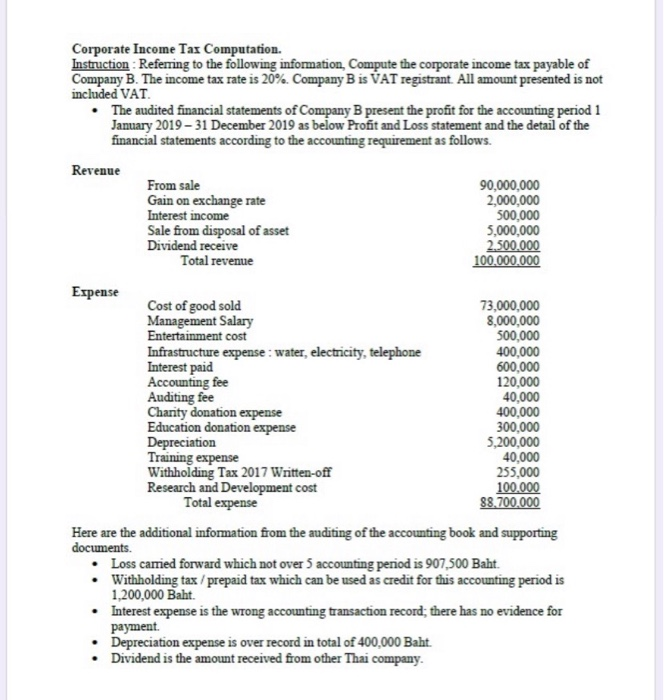

Solved Corporate Income Tax Computation Instruction Chegg Com

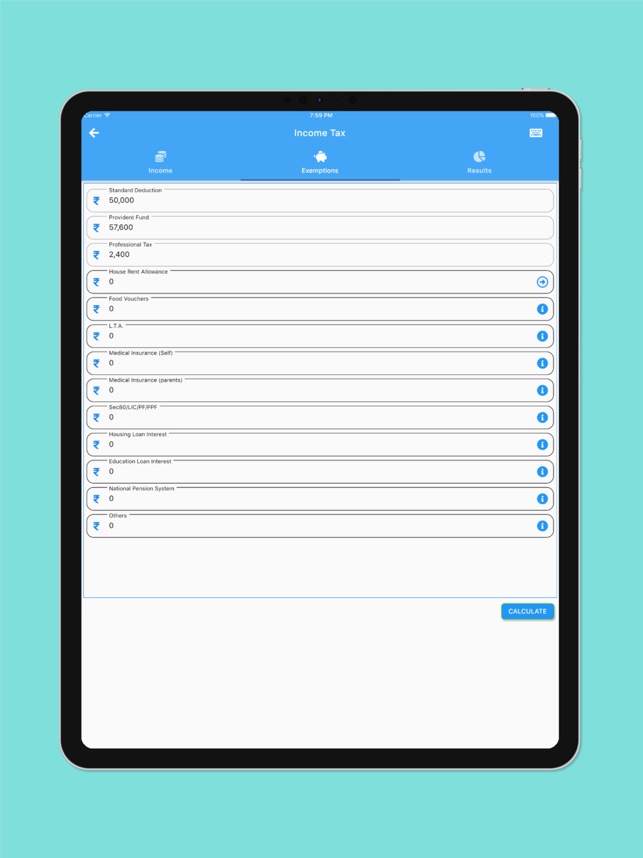

Tapraisal Income Tax Cal India On The App Store

0 Response to "section 4d rental income tax computation"

Post a Comment